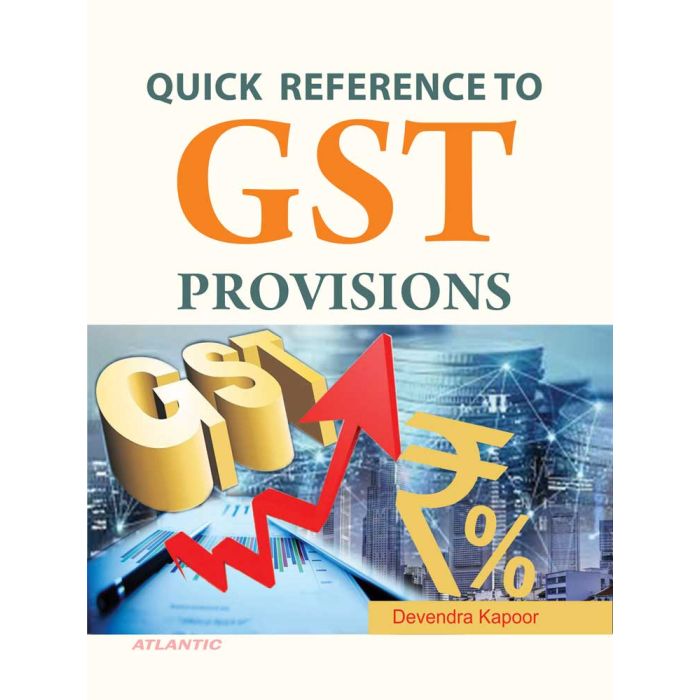

Quick Reference to GST Provisions (Paperback - 2021)

Ships in 1-2 Days! Cheapest Price Guaranteed. Exclusively Distributed by Atlantic All Over India!

About the Book :- The book has been compiled taking materials from various primary sources such as The Central Goods and Services Tax Act, 2017, and many other Acts published from time to time in The Gazette of India; circulars/notifications issued by Directorate General of Taxpayer Services—Central Board of Excise and Customs; circulars/notifications issued by Goods and Services Tax Council; and India Code—digital repository of all central and state Acts. It incorporates plethora of amendments, additions, deletions, modifications of provisions and rules under the Goods and Services Tax Acts. It includes multiple notifications both relating to tariff and non-tariff issues, issued by the Central Government.

Distinguished features of this book are:

• Comments by the author with respect to each section together with synopsis and key takeaways.

• More than 1300 labels to each sub-section/rule, proviso, and explanation of each chapter to save valuable time in retrieving the relevant details.

• Brief description of the subject matter of the section of different chapter mentioned in the parent chapter for seamless reading.

• Reproduction of the relevant section of borrowed provision from different enactments like Excise, Customs, Evidence Act, etc. for quick reference.

• Relevant rules applicable for a relevant provision have been mentioned below the section for speedy reference.

• Reference of Notifications necessitating changes in rules has been provided below the relevant rule.

• Bifurcated reference of notifications of tariff rates both for goods and services into different segments like taxable, exempt, reverse charge, etc.

• Reference to GST Forms applicable to relevant chapters has been segregated dealer and department wise for instant reference and purpose of the Form.

About the Author :- Devendra Kapoor, has four decades of corporate experience in handling commercial affairs of the companies of both national and international repute which include M/s DCM Group of Companies, Brooke Bond Lipton India Limited, and Hindustan Unilever Limited. Management of indirect taxation has been his area of specialization and he has been awarded HUL Director Excellence Award on more than one occasion for seamless transition to VAT and resolution of disputed cases involving classification, valuation, exemption, and documentation issues at various judicial forums. He has been member of Indirect Taxation Sub-Committee of Bengal Chamber of Commerce, Kolkata. He has been engaged for more than three years with leading business schools like MDI, Amity, and Techno, both in academic and non-academic areas. For the past three years he is associated with leading CA firms in Delhi, Gurugram, Bengaluru and Kolkata as senior consultant of indirect taxation.

| ISBN13 | 9788126932702 |

|---|---|

| Product Name | Quick Reference to GST Provisions (Paperback - 2021) |

| Price | ₹995.00 |

| Original Price | INR 995 |

| Author | Devendra Kapoor |

| Publisher | Atlantic Publishers and Distributors (P) Ltd |

| Publication Year | 2021 |

| Subject | Business Management |

| Binding | Paperback |

| Language | English |

| Pages | 816 |

| Weight | 1.300000 |

Login and Registration Form